I] TRANSACTION SYNOPSIS

| QIP Size | ~ ₹ 14,021 mn |

| Post Issue Dilution | ~ 22.0% |

| Market price (INR per share)* | ₹ 136.50 |

| Issue price (INR per share) | ₹ 129.25 |

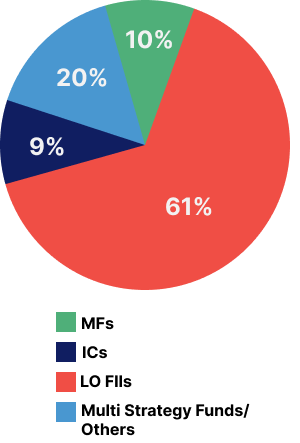

II] SELECT QIP INVESTORS AND QIP BOOK

- Amansa

- Birla MF + Offshore

- Bajaj Allianz Life Insurance

- FMR

- Govt. of Singapore

- HDFC Life Insurance

- Newport Asia

- Valiant

III] DEAL HIGHLIGHTS

- We successfully closed the 3rd transaction for Burger King in the last 15 months – Only Domestic Bank to be involved across all these transactions

Feb 22 – QIP (₹ 14,021 mn) / Dec 20 – IPO (₹ 8,100 mn) / Nov /Dec 20 – Pre-IPO (₹ 2,570 mn) - Led the QIP procurement with 2 out of the largest 3 Bids

- Book was oversubscribed despite volatile market scenario – market witnessed a sharp correction of ~8%^ from its high point during 1 month prior to launch

^ Movement of SENSEX between 1 month high and low

*As on date of filing of PPD – February 10, 2022, NS